Jimbo Fisher day coming soon just like Bobby Bonilla day

- Thread starter onewoof

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Kind of crazy that Weis is still so high

Because he only lost to Michigan State and USC by 3. Hilarious.Kind of crazy that Weis is still so high

Mullen's buyout at Florida was in the $12 million dollar range.

I wonder if the state of Texas will pay him as quickly as it did Leach?

Bobby Bonilla day will last into infinity though - both are next level dumbassery. I really hate that Bjork left Ole Miss.

Last edited:

Bryan Harsin is close to being on that list right? Auburn with Gus Bus and him have put out stupid payoff money as well.2/3rds of that total amount is Aggie ex coaches, crazy!

I wonder if, after the first two payments, there will an effort to settle?

He is due an additional $50ish mil over the next seven years. As there is a time value to money (this is why lottery winners take a lower lump sum rather than annuity) will he try to settle the $50mil debt for a lump sum of $35 mil or so?

Using the rule of 72, that $35 mil would be $70 mil in, or around, 2031.

I guess it's time to revisit when Bobby Bonilla day ends, and why it was shrewd and smart for all parties involved to do it the way it was done.Bobby Bonilla day will last into infinity thought - both are next level dumbassery. I really hate that Bjork left Ole Miss.

There are other players with much more ridiculous deferred payment plans. Bonilla just catches the grief because he was the first and he sucked.

You’d want to understand his rate of return,r, then divide the payment amount as PMT/(1+r)^t for each remaining period where t is the time period and sum those to get his present value of the what’s owed to him in contractI wonder if, after the first two payments, there will an effort to settle?

He is due an additional $50ish mil over the next seven years. As there is a time value to money (this is why lottery winners take a lower lump sum rather than annuity) will he try to settle the $50mil debt for a lump sum of $35 mil or so?

Using the rule of 72, that $35 mil would be $70 mil in, or around, 2031.

each of those payments will have different values since they’re paid at yearly intervals, so need to evaluate their value based on when they’re paid

You’d want to understand his rate of return,r, then divide the payment amount as PMT/(1+r)^t for each remaining period where t is the time period and sum those to get his present value of the what’s owed to him in contract

each of those payments will have different values since they’re paid at yearly intervals, so need to evaluate their value based on when they’re paid

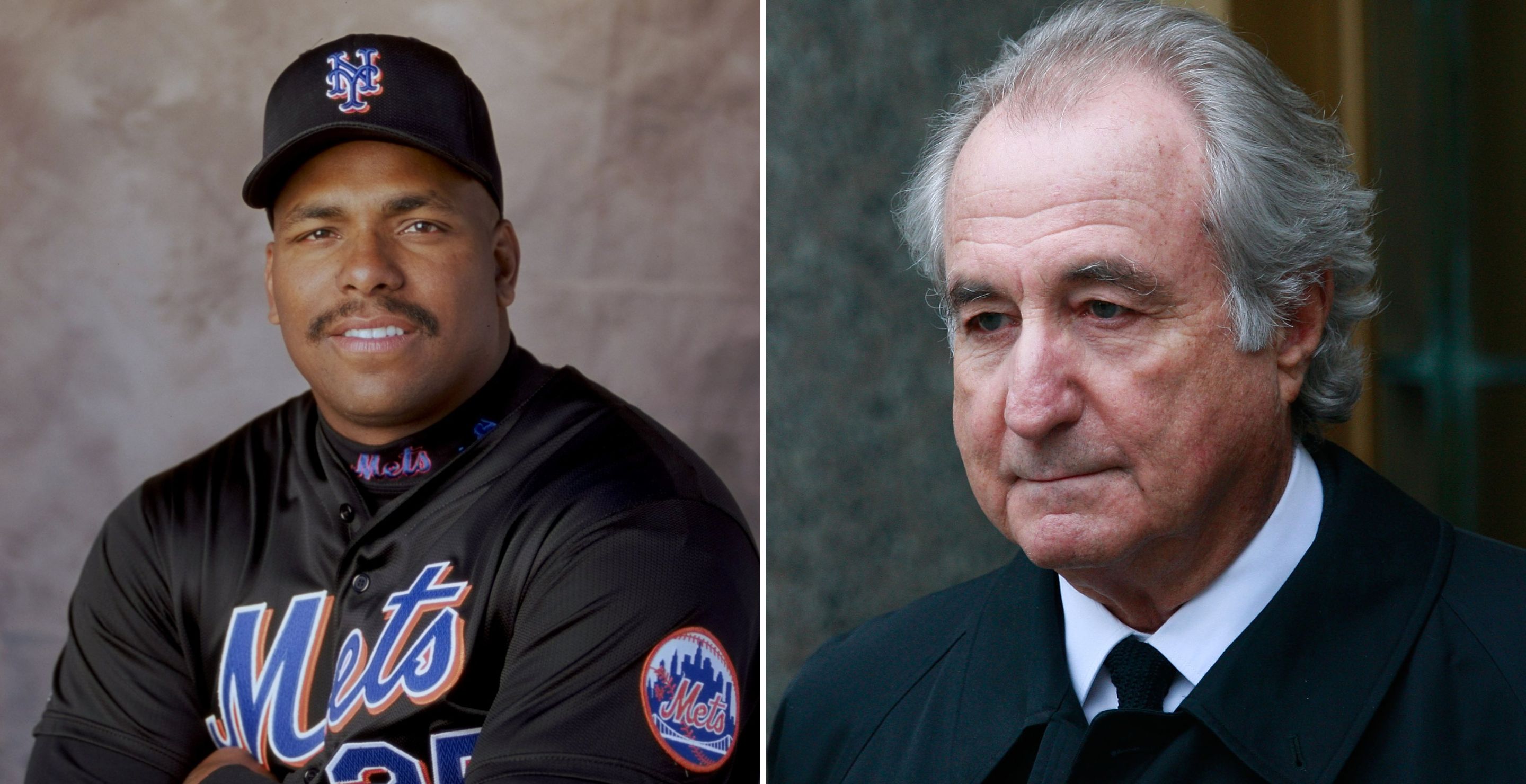

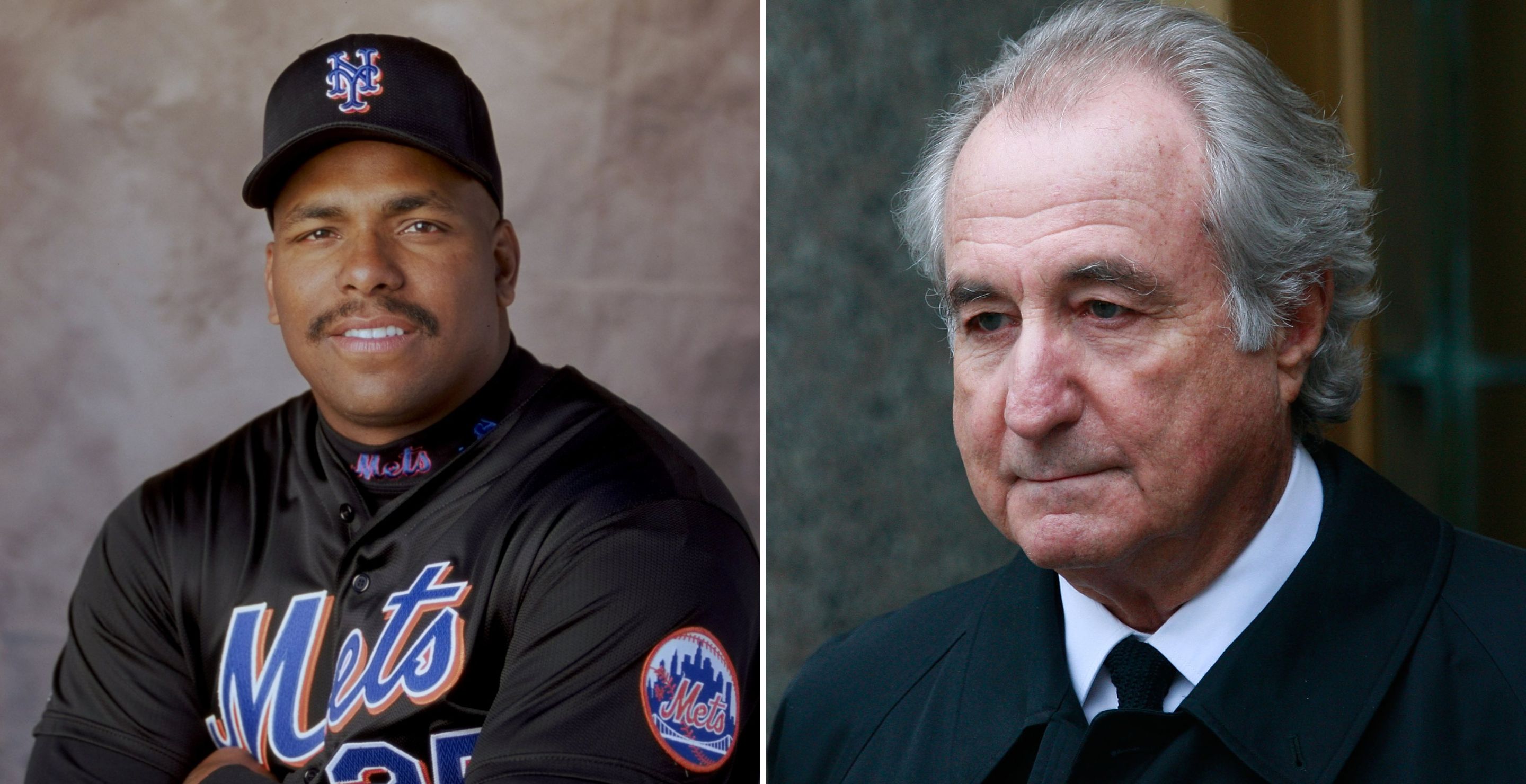

He wasn't the first. The Mets decided to pay him $30M deferred rather than a lump sum of $5.9M, because they were convinced they could put that $5.9M in their Bernie Madoff account and make more than $30M. I assure you, no contract financial deferment is dumber than that.I guess it's time to revisit when Bobby Bonilla day ends, and why it was shrewd and smart for all parties involved to do it the way it was done.

There are other players with much more ridiculous deferred payment plans. Bonilla just catches the grief because he was the first and he sucked.

I wonder if, after the first two payments, there will an effort to settle?

He is due an additional $50ish mil over the next seven years. As there is a time value to money (this is why lottery winners take a lower lump sum rather than annuity) will he try to settle the $50mil debt for a lump sum of $35 mil or so?

Using the rule of 72, that $35 mil would be $70 mil in, or around, 2031.

By deferring Bonilla's salary, the Mets were able to save enough payroll to trade for Mike Hampton. The Mets went to the World Series that year, with Hampton earning the NLCS MVP. When that season ended, Hampton left as a free agent and the Mets got a sandwich draft pick as compensation. With that draft pick, the Mets drafted David Wright.He wasn't the first. The Mets decided to pay him $30M deferred rather than a lump sum of $5.9M, because they were convinced they could put that $5.9M in their Bernie Madoff account and make more than $30M. I assure you, no contract financial deferment is dumber than that.

It couldn't have worked out any better for the Mets - they'd do it again 100 out of 100 times. There are worse deferment contracts out there - even by the Mets, who gave a ridiculous deferment to Bret Saberhagen as well.

When the Washington Nationals are still paying Stephen Strasburg 26m in 2029, is that also because of Bernie Madoff? Or is it just that deferred contracts have become standard practice?

It gets really exhausting having to educate you all the time.

The only exhausting thing is how you are consistently wrong yet somehow deluded as to it.By deferring Bonilla's salary, the Mets were able to save enough payroll to trade for Mike Hampton. The Mets went to the World Series that year, with Hampton earning the NLCS MVP. When that season ended, Hampton left as a free agent and the Mets got a sandwich draft pick as compensation. With that draft pick, the Mets drafted David Wright.

It couldn't have worked out any better for the Mets - they'd do it again 100 out of 100 times. There are worse deferment contracts out there - even by the Mets, who gave a ridiculous deferment to Bret Saberhagen as well.

When the Washington Nationals are still paying Stephen Strasburg 26m in 2029, is that also because of Bernie Madoff? Or is it just that deferred contracts have become standard practice?

It gets really exhausting having to educate you all the time.

They could have deferred the $5.9M for a LOT less than $30M, bro. That's what makes it so dumb.

The Nationals had nothing to do with Madoff. The Mets did.

How Bernie Madoff's Ponzi Scheme Created Bobby Bonilla's Infamous Contract

In the year 2000, the ownership group of the New York Mets made a decision that haunts the team today: buying-out Bobby Bonilla's contract.

fanbuzz.com

fanbuzz.com

The only exhausting thing is how you are consistently wrong yet somehow deluded as to it.

They could have deferred the $5.9M for a LOT less than $30M, bro. That's what makes it so dumb.

The Nationals had nothing to do with Madoff. The Mets did.

How Bernie Madoff's Ponzi Scheme Created Bobby Bonilla's Infamous Contract

In the year 2000, the ownership group of the New York Mets made a decision that haunts the team today: buying-out Bobby Bonilla's contract.fanbuzz.com

When you get a damn clue as to what you're talking about, come back and we'll talk.

Ok bro, fill me in on how deferring money at that rate is smart. The entire rest of the world, that defers money at much lower rates, would love to know.

When you get a damn clue as to what you're talking about, come back and we'll talk.