Friday 5: What would it cost for Notre Dame to sever its ACC ties?

The latest episode of blindsiding conference realignment has felled no further dominos two weeks later. Pandemonium has given way to (temporarily, surely) calmer waters. Notre Dame has new ideas and questions to ponder, but not ones that require urgent answers or action.

The SEC reportedly won’t expand beyond 16 teams right now. The Big Ten’s top target after adding UCLA and USC is widely reported to be Notre Dame, which remains content with independence – even as the money it leaves on the table by doing so becomes harder to ignore. The ACC, initially thought to be facing imminent danger, has not lost any members.

A lack of activity can be telling too, though. Two things are clear from it.

Everyone is waiting on Notre Dame, which knows it has the leverage to make any independence decision on its terms. And the ACC’s best weapon is its grant of rights that runs through 2036. It’s the duct tape holding the league together.

Why? As venerable ACC columnist David Teel pointed out, ditching it would be prohibitively expensive. For example, any ACC school that left now to join the Big Ten in 2024 (the same USC and UCLA timeline) would be forfeiting 12 years of TV revenue, which Teel conservatively estimated at $30 million per year. That’s an exit fee north of $350 million. Even for a program stepping into an immediate $70 million annual Big Ten or SEC TV payout that will likely hit $100 million by decade’s end, it’s a hefty price.

Proof of the difficulty of challenging a grant of rights in court and the unwillingness for teams to pay nine figures in fees rests in Texas and Oklahoma’s choice to remain in the Big 12 through 2024 – when its grant of rights expires. USC and UCLA will depart the Pac-12 in 2024 after that league’s grant is done.

Yet the last two weeks have seemingly re-enforced the idea that if Notre Dame goes to a conference, it won’t be the ACC. That’s a more realistic proposition now or in five years because it would not owe the same exit price. As a partial member, it receives significantly less TV revenue. In 2019, the ACC paid Notre Dame $10.8 million and its full members $32.4 million. Notre Dame could buy out of the same hypothetical 12-year window at a third of the cost.

“If Notre Dame wants to join the Big Ten or SEC, the ACC is virtually powerless to stop the move,” Teel wrote.

2. Blue chip rate

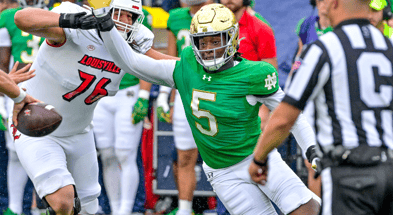

The “blue chip” percentage at the top of every team’s commit list at On3 is rooted in respected recruiting analyst Bud Elliott’s blue-chip ratio, which he first devised at SB Nation nearly a decade ago. The basis of the stat is any team that wants to win a national title must sign more blue-chip recruits (four- or five-stars) than two- or three-stars over a four-year period.

On3 computes it for each team’s individual class. Notre Dame’s No. 2-ranked 2023 haul is 84 percent blue chip recruits (16 of 19 commits). Adding four-star Austin Westlake wide receiver Jaden Greathouse on Friday would push it to 85 percent. Only twice has Notre Dame finished with a higher blue-chip percentage than 85: 2013 (87) and 2008 (100). Both classes were ranked fourth. (The On3 Consensus player rankings were used for all retroactively calculated blue-chip rates and class rankings).

The Irish’s 2023 class has six top-100 players, which is one more than 2021 and tied for their second-most in a single cycle since 2004. Their 2021 class finished ninth in the On3 Consensus Team Recruiting Ranking, though, because it had a 52 percent blue-chip rate. The No. 14-ranked 2019 class had an 81 percent blue-chip rate, but included just two top-100 players.

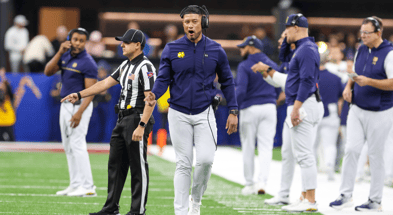

This is the height Notre Dame is banking on Marcus Freeman and his staff reaching. The Irish have had individual classes with high blue-chip rates but low top-100 yields (2019), high top 100 yields but lower blue-chip rates (2021) and classes that ranked lower in both (2020, No. 19 and 65 percent blue chip).

But rarely have they mixed both like this 2023 group does. Stringing those classes together is how Notre Dame can narrow the distance between itself and the few programs it’s chasing. Alabama, for instance, had an 88 percent blue-chip rate every year from 2019-22.

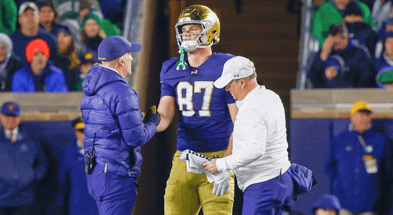

3. Mitchell Evans

To understand the impact of sophomore tight end Mitchell Evans’ foot fracture, circle back to position coach Gerad Parker’s description of him from April.

Top 10

- 1New

Bracketology

Let Texas, UNC argument begin

- 2Hot

SEC controversy

Alabama/UK score changed at halftime

- 3Trending

SEC executive

Fires back at Jay Williams, ESPN

- 4

Cooper Flagg

Availability moving forward

- 5

Lane violation

Head-scratching end to UNC, Duke

Get the On3 Top 10 to your inbox every morning

By clicking "Subscribe to Newsletter", I agree to On3's Privacy Notice, Terms, and use of my personal information described therein.

“Mitch really has unlimited resources in the pass game,” Parker said.

Notre Dame’s staff and players were enthused about Evans’ growth this spring after grabbing the No. 3 tight end role last fall. He made strides as a blocker. His receiving potential turned into more frequent production. He was in strong position to be the No. 2 tight end behind Michael Mayer. Now, he will have to wait until sometime later this season to try and regain that job.

Junior Kevin Bauman was the primary competition and figures to get the first look, but he will have three underclassmen pushing him who weren’t around in the spring. Sophomore Cane Berrong is at full health after an October ACL tear. Freshmen Eli Raridon and Holden Staes were June enrollees. Raridon tore his ACL in December, but is participating in summer workouts.

Bauman and Berrong might have grabbed the No. 3 tight end job last year if not for their own injuries. The former broke his leg in the opener at Florida State and did not play again until early November. Berrong had played in three straight games before his ACL tear. Both made positive impressions in 2021 fall camp.

4. The interior line

Notre Dame is likely to start fall camp with Zeke Correll at center and Jarrett Patterson at guard. The move shifts Correll back to the position he played from 2019 through spring 2021 (and where ended the 2021 season after a rough first half at guard). It also moves Patterson away from the position where he has made 34 straight starts, turned himself into an NFL prospect and is arguably the FBS’ best returning center.

Framed that way, it might seem like an odd decision.

The goal, though, is finding the best combination of five. Right now, it seems Notre Dame thinks a lineup with Correll at center and Patterson at a new position is better than one with Patterson at center and Andrew Kristofic or Rocco Spindler at guard. Camp will either confirm it or make the Irish continue tinkering.

It’s a testament to Correll that Notre Dame would consider moving its best center to guard to accommodate him. It’s also an impressive rebound after his move to guard last summer end ended with a benching after six starts. Correll’s last 18 months are a reminder that development and career trajectories are rarely linear.

5. Austin Novosad

Notre Dame has made the first move after resetting its 2023 quarterback recruiting in the wake of Dante Moore choosing Oregon. The Irish offered Dripping Springs (Texas) High’s Austin Novosad, a four-star Baylor commitment.

At this stage, he’s a shot worth taking. Five months until signing day is the time to aim high and attempt a head-turning flip. Novosad picked Baylor in December, but has visited Ohio State and Texas A&M this summer. He told On3 his recruitment is a “four-team race” after Notre Dame offered. He’s clearly open to other options.

If he does not choose Notre Dame, the Irish would hardly be in dire straits with timing. They can wait on fallback plans or players they consider hidden gems who they feel confident would jump aboard if they offered. They can wait until November to see if coaching changes spark decommitments or transfers. But right now, Novosad is the actionable choice. Entering the race suggests Notre Dame will explore all 2023 quarterback avenues.