Texas assessing how to "navigate the conflicting aspects of NCAA NIL policy and HB 2804"

It was no secret Texas HB 2804 and NCAA rules and regulations were in conflict when it comes to NIL. Battle lines were set to be drawn on July 1, the date the bill goes into effect, and Lone Star State schools, booster clubs, and NIL collectives would have to determine which side they were going to choose.

[Join Inside Texas today and get the best Texas Longhorns insider team info and recruiting intel!]

The NCAA prohibits institutions from providing special benefits to boosters for donating to NIL collectives, and says member schools must adhere to its rules regardless of what their state laws permit. HB 2804, signed by Texas Gov. Greg Abbott on June 10, opened the door for booster club loyalty points to be linked to with donations to collectives and shielded intercollegiate athletic programs from punishment from organizations like the NCAA for following the state of Texas legislation.

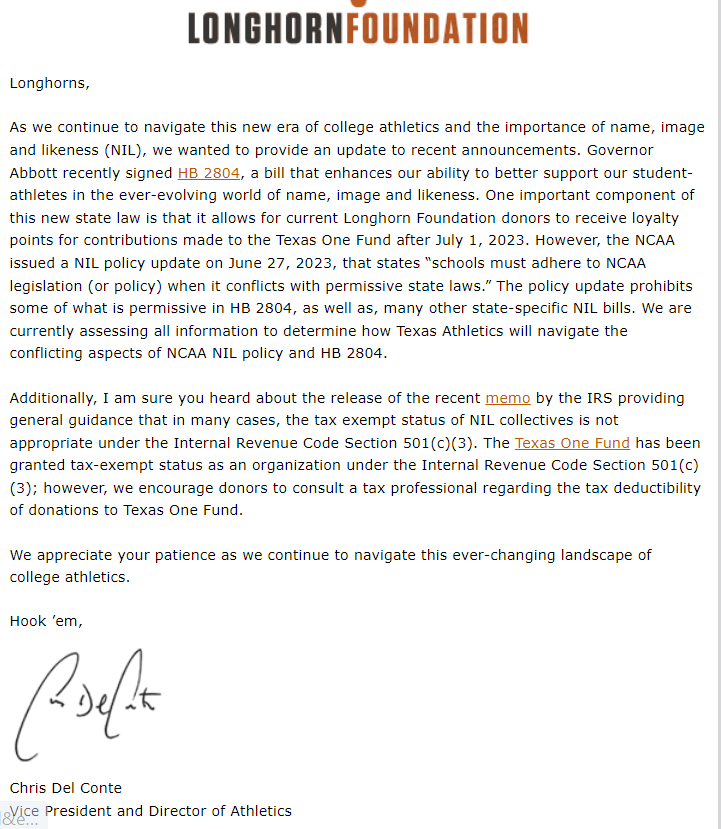

Texas athletic director Chris Del Conte said in a June 16 edition of the Forty Acres Insider that the state law “allowed for Longhorn Foundation donors to receive loyalty points for contributions made to the Texas One Fund after July 1, 2023, when the law goes into effect” and “additional detailed information regarding this opportunity will be forthcoming.”

Additional detailed information is here.

Del Conte sent a letter to donors on June 29, acknowledging the NCAA memo, saying Texas is “currently assessing all information to determine how Texas Athletics will navigate the conflicting aspects of NCAA NIL policy and HB 2804.”

Loyalty points determine priority for season ticket selection, seat upgrades, Red River Shootout and road tickets, plus postseason events. They are amassed through donations to the Longhorn Foundation, the official fundraising arm of Texas athletics. While the possibility to link loyalty points to donations to NIL collectives, in UT’s case the Texas One Fund, was an option, it’s not a road Del Conte and the Texas athletic department chose to go down at this time.

Top 10

- 1Breaking

MiLaysia Fulwiley

South Carolina transfer to LSU

- 2Hot

2nd Round NFL Mock Draft

QBs under microscope

- 3

Shedeur Sanders reacts

To going undrafted in 1st round

- 4

Marcus Spears fires back

At Stephen A. Smith over Shedeur take

- 5

Picks by conference

SEC, Big Ten dominate NFL Draft

Get the On3 Top 10 to your inbox every morning

By clicking "Subscribe to Newsletter", I agree to On3's Privacy Notice, Terms, and use of my personal information described therein.

Del Conte also spoke to the tax exempt status of donations to collectives. The Texas One Fund is a 501(c)(3) organization, but the Internal Revenue Service recently released a memo that explains in many cases, the tax exempt status is “not appropriate.” He encouraged donors to consult a tax professional regarding the deductibility of donations to the Texas One Fund.

The Texas One Fund was formed in November of 2022 when five separate UT athletics related collectives merged in order to “maximize community impact and be the preferred NIL fundraising collective for Texas student-athletes.”

The Texas One Fund was recently ranked as the No. 4 most ambitious collective entering Year 3 of the NIL era by On3. Texas One Fund executive director Patrick “Wheels” Smith spoke with On3’s Pete Nakos on June 19 about how positive the effect of the state law could be for Texas, Austin, donors, and student-athletes.

“It’s just another great asset for us,” Smith told Nakos. “Not only are we doing good things in the community. Not only are we helping our student-athletes, we’re also giving donors the benefit which is a game changer. As of now, it’s still a tax-deductible donation. The ability for them to get a tax deduction and loyalty points is a really good thing.”

For now, that plan is on hold as Texas looks to sus out which side of the battle it wants to be on.