Ramsey’s advice is aimed at the majority of the population who don’t pay off credit cards each month. He’s serving financial literacy to them. He’s really not targeting the “I already make good decisions but want to split hairs between investment vehicles” crowd. Sadly, most people fall into the first group. Odds are, some in this thread are in the first group.Ramsey's best quality is a lot of his advice does a good job of taking human imperfections into account. The debt snowball is a perfect example of this (plus has some benefits for risk management by lowering minimum monthly payments faster). The 15 versus 30 year mortgage is a less perfect example of this. Yes, a lot of people may spend the difference b/w a 30 year and 15 mortgage rather than invest it, but if you can't max your 401k and roth on a 15, then it's much easier to follow through with the investment part. You just set it and forget it. And once your to the point where you have the option of paying off your mortgage or investing, absent an inheritance or some other windfall, you probably have an established track record of being disciplined and should have a decent idea of whether you're likely to spend more because you have that money invested somewhere liquid rather than in home equity.

And unless something has changed, I would not trust anything he says about their research. The few things I've heard him say about their research he gives stats that have major and obvious selection biases of one sort or another, whether it be survivorship bias, volunteer bias, or just general sampling problems.

OT - Financial advisors

- Thread starter Seinfeld

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

^This. It's psychological. It's like the difference in a diet, saying "just eat less calories bro", and a diet that helps people actually stick to it. It's not just about the math. If you're seeking out how to invest, you probably don't need the psychological help, that's for people who've indebted beyond their means.On paper, sure. Ramsey’s advice is based on what most people do. They end up not investing it like their paper examples shows is superior. He’s also considering the psychological effects of being debt free. According to his research, once people are debt free, they accumulate wealth much faster due to decisions they make. If you don’t agree, take it up with him, but his plan isn’t just “pay off 2.75% interest instead of making 12%”.

IMO the best investment you can make is to game your taxes. A 20% discount is hard to beat. After you've exhausted your tax advantaged allowances, then paying down a mortgage vs a small private investment account probably weighs to the mortgage for the emotional benefit (depending on the rate and size).

I'll agree with this, especially the part about 99% of millionaire did it by such and such. I've never seen him actually admit that a million dollars isn't that much money these days. If you want to be conservative and be safe, his way is the way to go there. But I've leveraged a little debt to my advantage too, throughout the years.And unless something has changed, I would not trust anything he says about their research. The few things I've heard him say about their research he gives stats that have major and obvious selection biases of one sort or another, whether it be survivorship bias, volunteer bias, or just general sampling problems.

There is also something to the idea of creating urgency for yourself. As in, taking on an appreciating investment where you must make the payments, and finding out a way to actually make said payments. Such as a piece of real estate or company stock. Most people will never save up enough money to pay for that stuff outright, just because, well we're human. But if you finance it, then you're stuck making those payments, and you find a way. And those assets go up in addition to paying you rent/dividend/whatever.

Half my note is literally Taxes and Insurance....

Where do you live (generally)?

Did you put down a big down payment at closing?

Do you have a 30-yr mortgage?

A Roth IRA is a tax advantage account that is enabled by the government. They see the benefit of that account to be so great that they put a limit on the amount you can contribute each year. For 2024 the limit is $7000. If you contribute to that limit, you have maxed it out for the year.I've seen a few posts mention "maxing out" a Roth.

I know what a Roth IRA is, but what does it mean to "max out" a Roth?

So, let’s get back to the original topic. Forget that Ramsey guy. When do you need a financial planner or what circumstances make one more advantageous than just putting your savings into a mutual fund with a long track record of good performance? I recently talked to a rep from a financial planning company that’s a fiduciary. He was proud of their 8.5ish percent return they’ve averaged over the last 30 years, after their fees. I really wasn’t impressed. My 401k and an old IRA are making more than that over the last 7-10 years.

The closest thing to a financial advisor I ever had were a couple of guys that would come to our company and review our 401k plans with us. We had one on one meetings and sometimes group meetings. They were knowledgeable and helpful. But when I retired I rolled everything into Fidelity Investments and handle everything myself. It's not rocket science. But if you're one that has been lucky enough to accumulate mega dollars it may not be a bad idea to have a tax and financial advisor. I'm in decent shape but not in that bracket.

I guess I was wanting to get something different out of a financial advisor. I don’t have one currently, but am considering it now that we actually have built assets over our first 10 working years. Y’all are all talking about someone who manages your investments inside your existing accounts. I’ve wanted someone who is a 3rd party to me and the wife to help talk through financial goals, pre vs post tax allocations and retirement projections. If someone just offered to manage my accounts I would be highly disappointed.

Those are the things a good financial advisor will be the most help for you. Generally speaking, you should be putting at least 10% into tax deferred retirement accounts, including company match. If you do that & don’t go into retirement with any debts (including no mortgage), you should be fine for retirement. Then you can start looking at other financial goals.I guess I was wanting to get something different out of a financial advisor. I don’t have one currently, but am considering it now that we actually have built assets over our first 10 working years. Y’all are all talking about someone who manages your investments inside your existing accounts. I’ve wanted someone who is a 3rd party to me and the wife to help talk through financial goals, pre vs post tax allocations and retirement projections. If someone just offered to manage my accounts I would be highly disappointed.

I used to be. I was broke as a joke for many years. I am literally making 70k a year and had to use pawn shops sometimes at the end of the month. Dave is right absolutely about one thing. You have to get mad. You have to be sick and tired of being sick and tired.Ramsey’s advice is aimed at the majority of the population who don’t pay off credit cards each month. He’s serving financial literacy to them. He’s really not targeting the “I already make good decisions but want to split hairs between investment vehicles” crowd. Sadly, most people fall into the first group. Odds are, some in this thread are in the first group.

A million dollars is enough to do two chicks at the same time.I'll agree with this, especially the part about 99% of millionaire did it by such and such. I've never seen him actually admit that a million dollars isn't that much money these days. If you want to be conservative and be safe, his way is the way to go there. But I've leveraged a little debt to my advantage too, throughout the years.

There is also something to the idea of creating urgency for yourself. As in, taking on an appreciating investment where you must make the payments, and finding out a way to actually make said payments. Such as a piece of real estate or company stock. Most people will never save up enough money to pay for that stuff outright, just because, well we're human. But if you finance it, then you're stuck making those payments, and you find a way. And those assets go up in addition to paying you rent/dividend/whatever.

The Republic of TX.....lot of great things about her but property taxes and homeowners insurance is not one of them.Where do you live (generally)?

Did you put down a big down payment at closing?

Do you have a 30-yr mortgage?

Let's just say if I bought it for cash I still wouldn't be happy with my monthly "note." That's why it can be frustrating thinking that paying it off sets me free*** even though it would drastically increase my monthly/yearly cash flow. It's a trade off that I consciously choose to make given the other benefits of living where I live.

As a personal preference and a very conservative approach I always Finance maximum term and make my own 5, 10, 15 year loan. It takes discipline and knowing your amortization schedule but it allows for the fallback to the minimum if something unexpected happens. I've done that several times with non-housing related debt I paid off in less than a year but financed for multiple years. It's not an approach for everyone but it works for us.

Wealth managers and Financial advisors are 2 different animals.I guess I was wanting to get something different out of a financial advisor. I don’t have one currently, but am considering it now that we actually have built assets over our first 10 working years. Y’all are all talking about someone who manages your investments inside your existing accounts. I’ve wanted someone who is a 3rd party to me and the wife to help talk through financial goals, pre vs post tax allocations and retirement projections. If someone just offered to manage my accounts I would be highly disappointed.

Sounds like you have a case of the MondaysA million dollars is enough to do two chicks at the same time.

As goofy as this sounds a Financial planner helps you build a plan....a financial plan based on the goals you define. This could relate to paying off debt, a plan for savings or investments, college funds, new house purchase, etc. They are similar to a coach. If you have decent financial chops and handle your money pretty good then you probably know most of what they could bring to the table. If you lack a little discipline developing the financial plan or sticking to it they can help keep you on track.So, let’s get back to the original topic. Forget that Ramsey guy. When do you need a financial planner or what circumstances make one more advantageous than just putting your savings into a mutual fund with a long track record of good performance? I recently talked to a rep from a financial planning company that’s a fiduciary. He was proud of their 8.5ish percent return they’ve averaged over the last 30 years, after their fees. I really wasn’t impressed. My 401k and an old IRA are making more than that over the last 7-10 years.

A wealth manager usually deals with someone that has at least $500k-$750k minimum net worth and wants to minimize taxes and continue to grow their wealth. These need to be fiduciaries as many have said in this thread. Most people using wealth managers have already maxed out 401k contributions and aren't eligible for other retirement funds so they need to invest in other financial vehicles.

20% total savings if you can....if you can.Those are the things a good financial advisor will be the most help for you. Generally speaking, you should be putting at least 10% into tax deferred retirement accounts, including company match. If you do that & don’t go into retirement with any debts (including no mortgage), you should be fine for retirement. Then you can start looking at other financial goals.

You need to talk to someone now regardless of age or financial health. You need to get a plan on your long term goals, your average hoped for return and willingness to gamble largely based on your age and time to retirement, and get a plan. At that point its up to you to follow the plan and start putting money in the account. At this point the advisors involvement is largely going to be based on your account balance and your age. If you're 35 you might not need to talk to your advice very few years, if you 55 you need to talk to him at least once per year, and if youre retired then you need to physically meet once per year and talk several times in between. The amount of return on a given fund or portfolio is based largely on the amount of risk. High returns generally mean high risk during down times. The advantage of an advisor is their ability to spread your money around to try and take advantage of the good times but avoid the bad.So, let’s get back to the original topic. Forget that Ramsey guy. When do you need a financial planner or what circumstances make one more advantageous than just putting your savings into a mutual fund with a long track record of good performance? I recently talked to a rep from a financial planning company that’s a fiduciary. He was proud of their 8.5ish percent return they’ve averaged over the last 30 years, after their fees. I really wasn’t impressed. My 401k and an old IRA are making more than that over the last 7-10 years.

Last edited:

4. EFTsOne. Only deal with a fee based financial advisor who does not receive any compensation or commissions from the investments he recommends.

Two. Only hire an investment advisor when you have enough invested to justify the fee.

Three. Until then, pay down debts, live within your income (actually a little below), invest in 4* or 5* Morningstar rated mutual funds (index or target date funds are a good option).

5. Put all of your money on a Ravens 49ers Super Bowl because it’s rigged.

6. And this one is probably sound. If you see a thread titled degenerates. Bet the opposite of everything that is posted in that thread.

I suggest you make a second payment of a hundred bucks monthly to be applied to principal only. You will not miss the 100 and will reach 0 a few years sooner.I put my house on a 15 year amortization but other than that make no extra payments. At about 28, I made the decision just to start fully funding my 401-k and build a budget based on that. We were having one first kid at the time and just seemed like a good plan. Meanwhile, I had several friends throwing every dollar they had at their mortgage payment while sitting at sub 5% and in most cases sub 4% rate. Those friends have a mortgage with about $100 to $150k less than mine now due to the extra payments but my 401-k has about $250k more than at least one particular close friend that took the debt pay down method.

Everyone certainly has to do what makes them comfortable and I’m a debt adverse guy too, just seemed to me that rather than pay off cheap debt I should take advantage of a stock market that was constantly going up.

We should hit 16% this year and 20% next year. Getting daycare money back and will have no debts besides our house in a few months. Plan is to pay cash from here on out for cars and home improvements. Not really planning on attacking the house until later for some of the reasons many of you have stated, but it will get some attention in my 40s most likely.20% total savings if you can....if you can.

My advisor helps me review my company 401k options to make sure I have my allocation correct. I have my ROTH accounts with them, but that is about it. What they do is set up a financial plan for us by asking our goals and what we wanted our retirement to look like. They took all our info and gave us a plan and a percentage that we hit that goal. Every year we update it and see what has changed from our finances or of our goals have changed. He gives us 3 thing each year he recommends we consider doing that would help us reach our goals. The only time any of the advice has included more money under their management was opening a Taxable Brokerage account to start building my third bucket. That was not a first year suggestion and it lines up with the original plan.

I would recommend an advisor for the planning aspect. I could do it on my own and get a number and probably be fine. But I would have to get to 65 and find out I need to work 2 more years, or get their and realize I could have retired at 62.

I would recommend an advisor for the planning aspect. I could do it on my own and get a number and probably be fine. But I would have to get to 65 and find out I need to work 2 more years, or get their and realize I could have retired at 62.

Last edited:

Roth's are tax free when you withdraw and 401k's are tax free when you contribute. I have never understood the love for Roth's other than the ability to withdraw early.I've seen a few posts mention "maxing out" a Roth.

I know what a Roth IRA is, but what does it mean to "max out" a Roth?

From a growth and savings perspective, the only way a Roth has an advantage over a 401k is if you expect your tax rate to be higher in retirement than when you are actually working, raising kids, etc. I figure most people will have a lower tax rate in retirement than during their peak earning years. For most, maxing out the 401k should be priority one.

If you go to a decent investment firm or wealth advisory firm or whatever you want to call it, they will provide the services of a certified financial planner "for free". At the very least, they will give you a long term plan that shows what your assets are projected to do based on different savings rates and risk profiles and also show a withdrawal plan for after you stop working. This will include some recommendations on what order to fund your accounts (e.g., how much to put in 401k versus roth versus non-tax advantaged accounts).I guess I was wanting to get something different out of a financial advisor. I don’t have one currently, but am considering it now that we actually have built assets over our first 10 working years. Y’all are all talking about someone who manages your investments inside your existing accounts. I’ve wanted someone who is a 3rd party to me and the wife to help talk through financial goals, pre vs post tax allocations and retirement projections. If someone just offered to manage my accounts I would be highly disappointed.

If they are good, they will also talk with you enough to get an idea of when you might have big expenditures, so talk about replacement of cars, plans to potentially move into a bigger house, kids college, whether private school tuition is going to be a need, whether you want to buy any big toys like a boat or RV or invest in a vacation home or rental property, etc.

If they are really good they will get into spending with you and review your habits and whether you are doing anything wasteful or suboptimal compared to your stated goals. My impression is that most CFPs that are affiliated with an investment firm aren't going to do this largely because if people are working with them, they assume they don't really want/need help on that. But that's based on a pretty limited sample so I may be completely wrong on that.

If you're just working and on cruise control building up a nest egg, it's not going to move the needle a ton. When you want to start making life changes (retire early, purchase a second home, buy a business, adopt a herd of giraffes... Whatever.) That's where planners help you run through the scenarios of when and how to make it happen.So, let’s get back to the original topic. Forget that Ramsey guy. When do you need a financial planner or what circumstances make one more advantageous than just putting your savings into a mutual fund with a long track record of good performance? I recently talked to a rep from a financial planning company that’s a fiduciary. He was proud of their 8.5ish percent return they’ve averaged over the last 30 years, after their fees. I really wasn’t impressed. My 401k and an old IRA are making more than that over the last 7-10 years.

If you're talking advisors, that's different. If you are self employed, have a self directed IRA, or have a decent sized taxable investment portfolio, an FA can be valuable. Not much value in it if you're just playing around with 5 figures in a taxable account and everything else is in a 401k.

It's true that we can usually beat an advisor if we just dump everything into low fee index funds. It will average out to say 10% return, but that isn't a straight line... When you have a short time horizon for needing your investment (say a kid going to college in 2 years.) You need to pull some money out of the equity market and find something more stable or you could get in real trouble if you need to access your investment when the equity market poops the bed. FA's will typically have you complete a lot of paperwork on risk and goals and help you find how much to put in higher return investments and how much for more stable investments.

Biggest time for an FA or planner is when you are getting close to retirement. So make sure you hire a young one. Last thing you want is an FA that retires right before you.*

There's a Roth 401k and a Roth IRA. The Roth 401k has a combined contribution limit with other 401ks ($23k). Like you said, it gets taxed in the front end and not the back, which is likely only going to be better for people withdrawing $100k a year or something from it.Roth's are tax free when you withdraw and 401k's are tax free when you contribute. I have never understood the love for Roth's other than the ability to withdraw early.

From a growth and savings perspective, the only way a Roth has an advantage over a 401k is if you expect your tax rate to be higher in retirement than when you are actually working, raising kids, etc. I figure most people will have a lower tax rate in retirement than during their peak earning years. For most, maxing out the 401k should be priority one.

The

The Roth IRA is totally separate. It carries the Roth name because it gets taxed the same on the back end (Edit: NOT taxed on the back end), which makes it confusing, but it's contribution limits are entirely separate from any 401k stuff. $7k annually, with limitations on upper incomes being eligible. It is run by financial institutions, not plan administrators like 401ks. This is the one I regret not having funded until now. The advantage with this one is your gains grow tax free, no capital gains, no income taxes on dividends, interest, etc. It is obviously preferable to a private account, and should be funded before those.

Last edited:

To get by with 10% you really need to do it without fail for like 40 years. And even then you wouldn't be able to replace your income with a 5% real return. You'd replace around 50% of your income, count on social security for another 30-40%, and then count on expenses dropping.Those are the things a good financial advisor will be the most help for you. Generally speaking, you should be putting at least 10% into tax deferred retirement accounts, including company match. If you do that & don’t go into retirement with any debts (including no mortgage), you should be fine for retirement. Then you can start looking at other financial goals.

That of course does work, but aside from counting on no setbacks and a long career, it assumes you don't ever get raises above inflation. If you steadily increase your income beyond inflation and keep investing just 10%, you are not going to be able to maintain your same living standard at retirement. You have to keep upping the percentage if you are increasing your consumption as you move your income up.

You are crushing it early my man! Keep it up and you'll be mostly free in your 50s assuming you don't kill it earlier.We should hit 16% this year and 20% next year. Getting daycare money back and will have no debts besides our house in a few months. Plan is to pay cash from here on out for cars and home improvements. Not really planning on attacking the house until later for some of the reasons many of you have stated, but it will get some attention in my 40s most likely.

Bingo! Well done!My advisor helps me review my company 401k options to make sure I have my allocation correct. I have my ROTH accounts with them, but that is about it. What they do is set up a financial plan for us by asking our goals and what we wanted our retirement to look like. They took all our info and gave us a plan and a percentage that we hit that goal. Every year we update it and see what has changed from our finances or of our goals have changed. He gives us 3 thing each year he recommends we consider doing that would help us reach our goals. The only time any of the advice has included more money under their management was opening a Taxable Brokerage account to start building my third bucket. That was not a first year suggestion and it lines up with the original plan.

I would recommend an advisor for the planning aspect. I could do it on my own and get a number and probably be fine. But

Yep, the income limitation feature sucks!There's a Roth 401k and a Roth IRA. The Roth 401k has a combined contribution limit with other 401ks ($23k). Like you said, it gets taxed in the front end and not the back, which is likely only going to be better for people withdrawing $100k a year or something from it.

The Roth IRA is totally separate. It carries the Roth name because it gets taxed the same on the back end, which makes it confusing, but it's contribution limits are entirely separate from any 401k stuff. $7k annually, with limitations on upper incomes being eligible. It is run by financial institutions, not plan administrators like 401ks. This is the one I regret not having funded until now. The advantage with this one is your gains grow tax free, no capital gains, no income taxes on dividends, interest, etc. It is obviously preferable to a private account, and should be funded before those.

We ran a 5%+ and 6%+ deficit the last two years and there is not even a discussion of how we are going to fund SS and Medicare in the future.Roth's are tax free when you withdraw and 401k's are tax free when you contribute. I have never understood the love for Roth's other than the ability to withdraw early.

From a growth and savings perspective, the only way a Roth has an advantage over a 401k is if you expect your tax rate to be higher in retirement than when you are actually working, raising kids, etc. I figure most people will have a lower tax rate in retirement than during their peak earning years. For most, maxing out the 401k should be priority one.

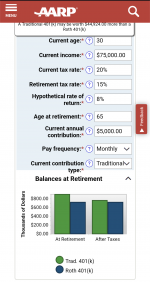

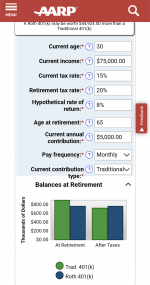

View attachment 515992

View attachment 515990

I think higher tax rates are a reasonable concern even if you are projecting less income in retirement. Certainly wouldn't go all in on roth as it's possible if not likely that any future increases come in the form of a VAT or other consumption tax, but if you max out a 401k and a roth IRA, that's about 23% of your money going into a roth (probably less assuming you have a match). That seems like a reasonable enough hedge on future taxes to me. I would agree that going all in on the roth seems highly likely to inefficient for the vast majority of workers.

Correct. They do.Use someone who has a fiduciary duty to act in your best interest and not simply view you as a profit center. I believe CFP's have an obligation to provide services in that context - someone here will correct me if I'm wrong.

Roth's are tax free when you withdraw and 401k's are tax free when you contribute. I have never understood the love for Roth's other than the ability to withdraw early.

As you hinted at - flexibility and control. You can withdraw contributions after 5 years, and in retirement there's no RMD requirement. Also, great for beneficiaries to inherit. The other is a tax hedge. I think it's reasonable to assume that at some point in the future there is going to be increased tax hikes across the board if we continue on the same pace, electing politicians that do nothing besides spend.

One investment vehicle that is not getting enough love on here is just a regular taxable account. The ability to tax harvest, access penalty free gains, and pass on with a step up in cost basis to beneficiaries.

If you can do all 3 types.... you greatly expand your options to maximize income with the lowest taxable burden.

Unless I missed where you’re not working now, the firm that your 401k is through has advisors that are more than happy to help you. Take advantage of that resource. Don’t let an old 401k just sit unsupervised. I will say that my advisor has presented many options out there that are more advantageous than the simple “pay off the house” and such. Ask your friends who they use and trust. An advisor is the way to go though. Someone is managing your 401k and getting paid for it. You might as well utilize that person or switch it to someone you can trust.

Agreed. I prefer the taxable account over both a 529 and Roth. We can plan all we want and sometimes it works out, but if something unplanned comes up it's sure nice to have access to your money penalty free.One investment vehicle that is not getting enough love on here is just a regular taxable account. The ability to tax harvest, access penalty free gains, and pass on with a step up in cost basis to beneficiaries.

If you can do all 3 types.... you greatly expand your options to maximize income with the lowest taxable burden.

I have always been curious how many people dump money into a 529 and have a kid either not go or drop out of college. That would suck. Still pay all the taxes and a 10% penalty.

For those of you have graduated beyond Dave Ramsey I recommend the Money Guy Show podcast.

Caleb Hammer is good if you want to listen to train wrecks of people working mostly low end jobs deal with their finances. I can only take it on doses.

Caleb Hammer is good if you want to listen to train wrecks of people working mostly low end jobs deal with their finances. I can only take it on doses.

Just our luck. The politicians will finally figure out how to get elected by raising taxes on retirees when Gen X is in retirement.We ran a 5%+ and 6%+ deficit the last two years and there is not even a discussion of how we are going to fund SS and Medicare in the future.

I think higher tax rates are a reasonable concern even if you are projecting less income in retirement. Certainly wouldn't go all in on roth as it's possible if not likely that any future increases come in the form of a VAT or other consumption tax, but if you max out a 401k and a roth IRA, that's about 23% of your money going into a roth (probably less assuming you have a match). That seems like a reasonable enough hedge on future taxes to me. I would agree that going all in on the roth seems highly likely to inefficient for the vast majority of workers.

Real danger to being a small generation. Baby boomers have essentially gone in dry on the rest of us. Once enough of them die off, there are more than enough millenials to turn around and 17 Gen X.Just our luck. The politicians will finally figure out how to get elected by raising taxes on retirees when Gen X is in retirement.

Are millennials capable of doing that? What if they “just can’t” on Election Day?Real danger to being a small generation. Baby boomers have essentially gone in dry on the rest of us. Once enough of them die off, there are more than enough millenials to turn around and 17 Gen X.

I'm praying they don't go after our 401ks or accumulated savings accounts with a " Wealth Tax".....you want to piss off people more than taking their guns go after their life savings.Just our luck. The politicians will finally figure out how to get elected by raising taxes on retirees when Gen X is in retirement.

Before you dismiss it just think about the situation we are in. Also, the general masses that benefit wont care about taking from the disciplined that sacrificed and saved....see school loan forgiveness. Something has to be done to fund the future and taking from the evil privileged "wealthy" which will be anyone with decent 7 figure retirement savings will be an easy political sell to the masses. You will see this talk track by the end of the decade....book it.