OT: Markets........

- Thread starter GloryDawg

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

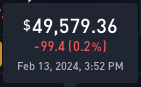

It always turns.Taking a beating right now. I hope it turns.

How far will it go down before it turns. I hope it turns today is what I meant.It always turns.

Healthy breather.

Market has been overbought the last couple weeks by every metric. Market has also continued to underestimate* the Fed's willingness to tame inflation.

Market has been overbought the last couple weeks by every metric. Market has also continued to underestimate* the Fed's willingness to tame inflation.

Last edited:

I think the opposite. The market has assumed the Fed will cut rates soon and often. The Fed keeps saying they won't. Today's numbers made the latter more likely, thus the downgrade of the market and rising bond rates.Market has also continued to overestimate the Fed's willingness to tame ininflation.

My bad. Unless you are 5-7 years from retirement, my theory is that a day makes no difference unless:How far will it go down before it turns. I hope it turns today is what I meant.

1) I have cash to push into a down market.

2) We face some existential threat that cannot be predicted and permanently disrupts/dismantles the market, in which case, tip of the hat to the survival seed guys!

I interpret the market today as reacting to hotter-than-expected inflation numbers. Higher inflation numbers decrease the probability the Fed will lower interest rates in the near term. Yesterday, the market was predicting a 60/40 chance the Fed will lower rates in May. The first rate cut is now priced in for June.

Exactly. Unless you have to sell equities in the near future and do no have cash or fixed income (CD, Bonds etc) to sell in down times, it is good for the consistent, long term investor.My bad. Unless you are 5-7 years from retirement, my theory is that a day makes no difference unless:

1) I have cash to push into a down market.

2) We face some existential threat that cannot be predicted and permanently disrupts/dismantles the market, in which case, tip of the hat to the survival seed guys!

I guess I have seen so many of these dips over the years and yet the markets end up eventually, it just doesn't bother me.

As long as I am buying (investing) instead of selling, it just looks like I am getting something on sale.

The S&P was up 22% since the end of October without a single pullback. I would fully expect a retest of the January 22' highs around 4800 within the next few weeks. That would not only be normal, but necessary and only 5% off the high.

I'm sure it will turn around. I just wonder how long we could keep playing the spend game without any consequences. I know we have to spend on some things but good Lord. No skin off my nose because it'll be my grandchildren that pays it back, not me.

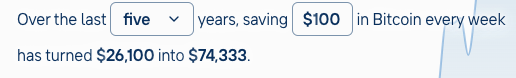

Try to explain that this also applies to bitcoin, and people will get angry with you, lolExactly. Unless you have to sell equities in the near future and do no have cash or fixed income (CD, Bonds etc) to sell in down times, it is good for the consistent, long term investor.

I guess I have seen so many of these dips over the years and yet the markets end up eventually, it just doesn't bother me.

As long as I am buying (investing) instead of selling, it just looks like I am getting something on sale.

To some, including this in your savings plan makes you a crazy, irresponsible person:

A LOT of down days are included in those numbers.

Try to explain that this also applies to bitcoin, and people will get angry with you, lol

To some, including this in your savings plan makes you a crazy, irresponsible person:

View attachment 527976

A LOT of down days are included in those numbers.

for what? **It always turns.

Question

I’m 6 months from retirement.

Should I still invest in company supported 401k plan?

Thanks in advance

I’m 6 months from retirement.

Should I still invest in company supported 401k plan?

Thanks in advance

Depends. You will have lower total income for this year, so may not owe income tax. Be sure to consider cashed out PTO as income. If you aren't going to owe income tax (NOT the same as a refund) in 2024, then it's better to put it in a Roth IRA.Question

I’m 6 months from retirement.

Should I still invest in company supported 401k plan?

Thanks in advance

It can’t go up forever. Everything has a correction at some point.

You should try to tie your whole livelihood to the corn rice and soybean markets and see how that goes. It hasn’t been a pleasant few months.

You should try to tie your whole livelihood to the corn rice and soybean markets and see how that goes. It hasn’t been a pleasant few months.

The S&P was up 22% since the end of October without a single pullback. I would fully expect a retest of the January 22' highs around 4800 within the next few weeks. That would not only be normal, but necessary and only 5% off the high.

That makes sense. I got out of a crappy managed fund around then with the intention of slowly putting back in sp500... I guess I should have dumped it all in immediately.

I also sold half my Intel at $38 a month later.

For a fee, I can post my market moves and you can do the opposite, that way we all win.

Riding the MSFT/AI Wave.

It goes Ex Dividend tomorrow.

How long to, or do you hang on.?

Bad day, today.

It goes Ex Dividend tomorrow.

How long to, or do you hang on.?

Bad day, today.

Too many variables. For instance, my wife’s company plan only charges $25 per year in fees where my Edward Jones accounts charge 1.12%.Question

I’m 6 months from retirement.

Should I still invest in company supported 401k plan?

Thanks in advance

bought that miner dip today. my powder was starting to stale. wth bought some solana too. but really dips don’t matter just buy

This is a helpful article that makes the case bitcoin, not crypto:bought that miner dip today. my powder was starting to stale. wth bought some solana too. but really dips don’t matter just buy

Crypto vs. Bitcoin: What You Need to Know | River Learn - Bitcoin Basics

Which digital asset is better for your investment portfolio; which is more likely to be profitable and carries less risk over the long-term?

river.com

“Bitcoin is more likely to be a profitable investment than taking big risks in crypto. Successfully trading crypto (or any asset) is difficult to do—especially when insiders have access to information that you do not. Furthermore, data shows that as an investment’s time horizon is extended, bitcoin is a better investment option than crypto, the S&P500, gold, or U.S. treasuries.”

i’m a btc believer. miners move about 5x to btc. the sol play is just fun. the btc returns have been so great why not play some for that lamboThis is a helpful article that makes the case bitcoin, not crypto:

Crypto vs. Bitcoin: What You Need to Know | River Learn - Bitcoin Basics

Which digital asset is better for your investment portfolio; which is more likely to be profitable and carries less risk over the long-term?river.com

“Bitcoin is more likely to be a profitable investment than taking big risks in crypto. Successfully trading crypto (or any asset) is difficult to do—especially when insiders have access to information that you do not. Furthermore, data shows that as an investment’s time horizon is extended, bitcoin is a better investment option than crypto, the S&P500, gold, or U.S. treasuries.”

Greatest marketing campaign of all time

We are the most selfish generation in the history of our country because of the debt we are loading on our children and grandchildren. It’s so very wrong and shameful.I'm sure it will turn around. I just wonder how long we could keep playing the spend game without any consequences. I know we have to spend on some things but good Lord. No skin off my nose because it'll be my grandchildren that pays it back, not me.

Charging over 1% is almost criminal in todays world. Fidelity charges me between zero percent and fractions of one.Too many variables. For instance, my wife’s company plan only charges $25 per year in fees where my Edward Jones accounts charge 1.12%.

Just curious if EJ is getting you better returns than a S & P index fund? Which was about 24% in 2023.Too many variables. For instance, my wife’s company plan only charges $25 per year in fees where my Edward Jones accounts charge 1.12%.

There are plenty of people who are not going to get the s&p 500 return in an s&p 500 ETF.Just curious if EJ is getting you better returns than a S & P index fund? Which was about 24% in 2023.

Last edited:

How can you compare bitcoin to the S&P 500, gold, and US Treasuries on an extended time horizon? Bitcoin has been around about 10 years. Gold has been a unit of exchange for all of recorded history. Stocks and government debt have been traded for hundreds of years.This is a helpful article that makes the case bitcoin, not crypto:

Crypto vs. Bitcoin: What You Need to Know | River Learn - Bitcoin Basics

Which digital asset is better for your investment portfolio; which is more likely to be profitable and carries less risk over the long-term?river.com

“Bitcoin is more likely to be a profitable investment than taking big risks in crypto. Successfully trading crypto (or any asset) is difficult to do—especially when insiders have access to information that you do not. Furthermore, data shows that as an investment’s time horizon is extended, bitcoin is a better investment option than crypto, the S&P500, gold, or U.S. treasuries.”

You can't just look at a positive year like last year to answer that question. Add in 2022 and the S&P 500 had a whooping 0% return from January 22' to January 24'.Just curious if EJ is getting you better returns than a S & P index fund? Which was about 24% in 2023.

Active management and/or advisor run accounts should smooth out the lows and highs. They will usually come in close, but not always equal to the performance of risk equatable index funds. The difference being whether you value a relationship with a person who can talk you through your goals and concerns or the compound savings of .5-1% if you find an index fund comparable to your risk tolerance.

My guess would be if you have the stones to throw it all in an index fund and never look back you can't be beat. But many don't have those stones and try to time the market and sell out when it's low (fear) and buy when it's high (greed).

I just checked a corn ETF. Sucks to be involved in one of a handful of businesses that's in deflationary mode.It can’t go up forever. Everything has a correction at some point.

You should try to tie your whole livelihood to the corn rice and soybean markets and see how that goes. It hasn’t been a pleasant few months.

Attachments

Cool. I didn't know Jim Cramer posts here.For a fee, I can post my market moves and you can do the opposite, that way we all win.

That's exactly what I do. When i sense trouble, I jump to cash, them move back when my fears subside. No judgement on what anyone does. The few folks I know who use paid advisors have returns less than mine over the years.My guess would be if you have the stones to throw it all in an index fund and never look back you can't be beat. But many don't have those stones and try to time the market and sell out when it's low (fear) and buy when it's high (greed).

This is most likely the answer. Uncertainty because inflation surprised the market. 2022 CPI 6.5%, /2023 CPI 3.4% January /2024 CPI 0.3%I interpret the market today as reacting to hotter-than-expected inflation numbers. Higher inflation numbers decrease the probability the Fed will lower interest rates in the near term. Yesterday, the market was predicting a 60/40 chance the Fed will lower rates in May. The first rate cut is now priced in for June.

is this a subliminal pitch to buy gold?bought that miner dip today. my powder was starting to stale. wth bought some solana too. but really dips don’t matter just buy

To answer your original question, no he didn’t earn 24% last year, but I didn’t expect to. Being retired I’m invested very conservatively I have a “Play “ brokerage account that I manage and has about 15% of my total worth invested, it made 48% last year. . I lost my *** in 21-22. My EJ account didn’t. I’m just not confident enough to gamble my entire net worth on my hunches, I’d rather pay a professional. I know just enough about investing to get me in trouble.That's exactly what I do. When i sense trouble, I jump to cash, them move back when my fears subside. No judgement on what anyone does. The few folks I know who use paid advisors have returns less than mine over the years.

Get unlimited access today.