Opendorse releases NIL budgets, fair market value tech for revenue sharing

Opendorse is releasing new technology Thursday to assist collegiate leaders in figuring out how to operate in the next era of college sports.

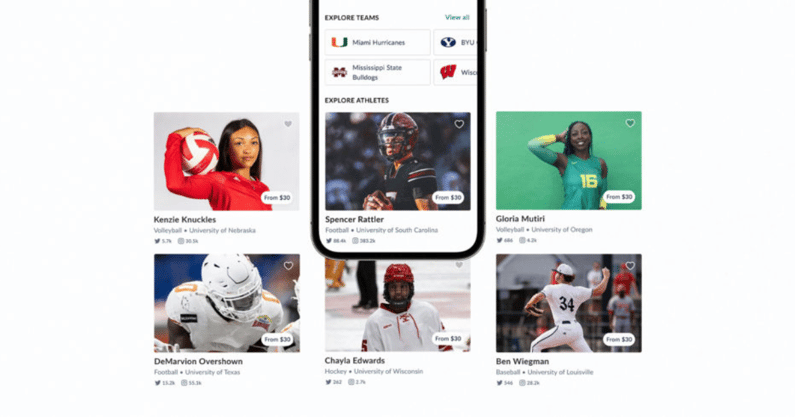

The NIL marketplace is rolling out a Fair Market Value (FMV) solution to assist athletic departments in distributing revenue-sharing funds. Another tool, Budgets, assists with cap management, providing market data across sports and position groups to athletic directors.

The move comes as athletic departments across the country are spending significant time this summer figuring out how to disperse revenue and find the funds to share up to $20 million annually with athletes.

That’s the new reality since the NCAA and power conferences signed off on a settlement agreement in the House, Hubbard and Carter lawsuits last month. As part of the multibillion-dollar settlement, schools will have the opportunity to opt-in to a revenue-sharing agreement. On-field corporate sponsorships could be coming, too, opening up a new revenue stream.

“They’re [schools] going to be paying $20 million a year for NIL activities, and if they do not get any value out of it, that is just an ignorant approach to this new world,” Opendorse CEO and co-founder Blake Lawrence said. “So they [schools] should be saying, ‘OK, I know I want to pay this athlete $180,000 a year. What NIL activities, based on just their individual marketing value, should I ask them to do to justify these payments?'”

Opendorse revenue-sharing payment solution

Along with the release of FMV and Budgets, Opendorse is opening its Payments program to universities. The tech is used by over 40 NIL collectives already to send contracts and schedule NIL payouts. Athletic departments can use it to send revenue-sharing payments and offer reporting to the NCAA or third-party compliance solutions.

Through the technology, institutions can look at anonymized budgets from schools nationwide that will be updated in real-time along with comparable budget allocations from professional sports teams. This will be crucial for universities trying to work through revenue sharing in sports like football and basketball.

Top 10

- 1Breaking

Shedeur Sanders

Not selected in NFL Draft 1st round

- 2New

Picks by conference

SEC, Big Ten dominate NFL Draft

- 3

Joel Klatt calls out

'Trash' Shedeur Sanders narrative

- 4

10 Best Available Players

After NFL Draft 1st Round

- 5Hot

ESPN roasted

For Shedeur Sanders empty couch

Get the On3 Top 10 to your inbox every morning

By clicking "Subscribe to Newsletter", I agree to On3's Privacy Notice, Terms, and use of my personal information described therein.

FMV will also provide assessments to athletes, allowing them to see a breakdown of their activity-based earnings. According to Lawrence, this will ensure athletes can negotiate NIL compensation.

“So, it’s individualized rates for athlete activities,” Lawrence said. “And that’s something that’s patent pending for us, and the technology is going to drive that. And then the next 14 months for us are deeper dives into the individualized earnings of athletes at partner schools so that we can have a defensible number for when anything is called into question of fair market value.”

Lawrence envisions athletes needing tools to determine their own fair market value against the NCAA’s designation. Teamworks landed the contract with the NCAA to establish the governing body’s agent registry, disclosure database and education program.

Opendorse’s technology will allow institutions to see how other schools are budgeting revenue sharing for starting quarterbacks and other positions, for example. The soonest revenue sharing could go into effect is the beginning of the 2025-26 academic year, however, most college athletics leaders are working to find answers now.

“We’re determined to be prepared for the challenges and opportunities that revenue sharing will

bring,” TCU athletic director Jeremiah Donati said in a statement. “We’re fortunate to work closely with our NIL partners at Opendorse as we get ready. Their earnings data and insights into this market are invaluable and will be key to our planning in the years ahead.”