To settle this debate, my wife’s take home almost 5 times what daycare costs per month. I make more money but she does fine, too. We are very much co-dependent.Haven't read the replies, but unless your ole lady's take home is double of day care, I'd consider her staying at home full time. Especially if she has a hobby she can make a little scratch on.

OT: Budgeting Tips

- Thread starter MSUDC11-2.0

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Why don’t you live with GF. that’s a sweeter dealFirst of all I'm single with no kids and no mortgage, a very sweet deal on rent and a girlfriend who lives 2 hours away that is loaded.

Back when I was in debt I Dave Ramsey'd it. Beans and rice, rice and beans and saved enough to start paying off my higher interest debt then whittled everything else down to zero pretty quickly. Now I only have a little credit card debt but its very manageable. I put 15% in my 401k, eat cheap at home and budget for MSU sports and vacations of which I take about 3 per year. On vacations, which are usually cruises with a trip to Vegas every now and then, we split the costs. I pay for airfare and she pays for hotel/rental car and we each pay our own way on a cruise. For the Vegas trips, we're set up well as MGM gold card members due to our Royal Caribbean tier status so that makes those trips very cheap since neither of us really gamble.

17 off. I wasn't argumentative- I was pointing out that assuming the wife makes less is an odd assumption- and then I quickly moved on to discuss the idea that 2x the cost of day are is what's needed for takehome pay for daycare to be the correct choice.Shut up, just trying to be argumentative

If your wife makes that much more than you. DUH

If someone wants to argue against my first point, then they are the one arguing.

Depends on what she does and if she's ever planning on working again... Not a big deal if she's a school teacher or nurse and can effectively pick it right back up. But stalling your career for 5-10 years is a killer in the corporate world.Haven't read the replies, but unless your ole lady's take home is double of day care, I'd consider her staying at home full time. Especially if she has a hobby she can make a little scratch on.

My wife was in her late 20's and early 30's making probably less than double our child care expenses when we first had kids. She was also paying her dues and really laying the foundation for her career. She continued working and by 40 she was a senior executive for a multi billion dollar company making 10-20x the cost of daycare. Had she stayed home she would probably be working in a local insurance office as an admin assistant or something.

The single greatest financial decision of our lives was having my wife continue to work and putting our kids in daycare vs having her stay at home and freelance.

(This may be a little OT.)

Remembered a good one. A college education costs a small fortune and IMO it's best if kids don't start adult life with a lot of student debt. So, at a very early age, start telling your kids that you will pay for them to go 2 years to in-state community college and 2 years to in-state university. However, they can go anywhere they like and as long as they like but they'll make up the cost difference in scholarships, work-study, student loans, etc.

Remembered a good one. A college education costs a small fortune and IMO it's best if kids don't start adult life with a lot of student debt. So, at a very early age, start telling your kids that you will pay for them to go 2 years to in-state community college and 2 years to in-state university. However, they can go anywhere they like and as long as they like but they'll make up the cost difference in scholarships, work-study, student loans, etc.

Even if I’m wrong I’m rightIf someone wants to argue against my first point, then they are the one arguing.

We have a 529 plan for my daughter that I wish had more in it but I’ve got time to catch up, as she’s 16 years away from college. But yeah student debt sucks. I was fortunate to not have any but I married into a good bit of it. That said I take responsibility for dealing with it too and I definitely want my daughter to have school paid for as much as possible.(This may be a little OT.)

Remembered a good one. A college education costs a small fortune and IMO it's best if kids don't start adult life with a lot of student debt. So, at a very early age, start telling your kids that you will pay for them to go 2 years to in-state community college and 2 years to in-state university. However, they can go anywhere they like and as long as they like but they'll make up the cost difference in scholarships, work-study, student loans, etc.

She is a rebelbearshark living in Oxford. I have a good job in the Golden Triangle and live 5 minutes from campus.Why don’t you live with GF. that’s a sweeter deal

You have your head on straight. Steady as she goes. Continue to be reasonable and disciplined.

This is the hard part - don't get envious of what's going on in your friends/neighbor's homes. Lots of poor financial examples out there. Don't make yourself miserable by being excessively frugal but don't be tempted by what the Jones's are doing either. Odds are they are maxing out credit cards and have jack saved for rainy days or retirement.

This is the hard part - don't get envious of what's going on in your friends/neighbor's homes. Lots of poor financial examples out there. Don't make yourself miserable by being excessively frugal but don't be tempted by what the Jones's are doing either. Odds are they are maxing out credit cards and have jack saved for rainy days or retirement.

Stick to the list. Critical.. We stick to the list.

Home prices hit another new high in June. Which means rent probably did too. You just have to wonder when a correction is coming, or if it's coming.

The national median sales price rose 4.1% from a year earlier to $426,900, the highest on record going back to 1999. At the same time, sales of previously occupied U.S. homes fell in June for the fourth straight month as elevated mortgage rates and record-high prices kept many would-be homebuyers on the sidelines.

The national median sales price rose 4.1% from a year earlier to $426,900, the highest on record going back to 1999. At the same time, sales of previously occupied U.S. homes fell in June for the fourth straight month as elevated mortgage rates and record-high prices kept many would-be homebuyers on the sidelines.

Demand for degrees is waning by employers(This may be a little OT.)

Remembered a good one. A college education costs a small fortune and IMO it's best if kids don't start adult life with a lot of student debt. So, at a very early age, start telling your kids that you will pay for them to go 2 years to in-state community college and 2 years to in-state university. However, they can go anywhere they like and as long as they like but they'll make up the cost difference in scholarships, work-study, student loans, etc.

Yep--there are viable alternatives to college.

The Ramsey plan works every time if you stick to it & follow it...first thing is to do a line item budget, and both of you stick to it. You'd be amazed how much trickles away. It won't work if you don't follow the rules or half-*** it. Get a small emergency fund(which you already have), and stop investing long enough to get that student loan paid off. Throw ALL extra money at your only debt, then you can start back....it won't take that long when throw big chunks at it.

Cut up all the credit cards...you have a bank card....only use it. Yes, you had a lot happen in a short period of time, but the good news is it's over and done with now. Move forward and clear the debt....it won't take long with yalls income.

Cut up all the credit cards...you have a bank card....only use it. Yes, you had a lot happen in a short period of time, but the good news is it's over and done with now. Move forward and clear the debt....it won't take long with yalls income.

You are smack in the messy middle. I’m there as well. My wife and I make a similar income as you and just got through with paying for daycare. We bought our house in 2020 so that has saved us from getting eaten alive by housing costs thankfully. Both our cars are paid for and reliable. We have no debt besides our house. Eat at home with meal prep on Sundays. Shop at Aldi and Walmart and not Kroger, Target or Fresh Market.

My wife and I know what we want out of life. We talk very candidly about finances, goals and our desires. We are blessed to be 95% aligned on everything and the stuff we aren’t we compromise with each other on. This allows us to cut through the noise of the world and focus our lives on what matters to us.

All that to say when it comes to our spending those conversations dictate how we spend. I setup the savings and bills amounts and we spend what is left over. It’s what some call cash flow management.

You guys are fine. There are a few times I’ve felt like you do now. This is a hard time in many ways and especially financially. Trust me when you stop paying daycare you’ll feel like you hit the lottery.

My wife and I know what we want out of life. We talk very candidly about finances, goals and our desires. We are blessed to be 95% aligned on everything and the stuff we aren’t we compromise with each other on. This allows us to cut through the noise of the world and focus our lives on what matters to us.

All that to say when it comes to our spending those conversations dictate how we spend. I setup the savings and bills amounts and we spend what is left over. It’s what some call cash flow management.

You guys are fine. There are a few times I’ve felt like you do now. This is a hard time in many ways and especially financially. Trust me when you stop paying daycare you’ll feel like you hit the lottery.

And gave those huge Covid sick leave credits and Employee rentention credits. There is so much fraud in both.... many people got $30k - $300k of cash money from the Treasury.The government printed way too much money during COVID. 1 stimulus was needed. The rest was overkill.

Yeah....there's really no argument against it. The drawback is if you don't have good income.The Ramsey plan works every time if you stick to it & follow it...first thing is to do a line item budget, and both of you stick to it. You'd be amazed how much trickles away. It won't work if you don't follow the rules or half-*** it. Get a small emergency fund(which you already have), and stop investing long enough to get that student loan paid off. Throw ALL extra money at your only debt, then you can start back....it won't take that long when throw big chunks at it.

Cut up all the credit cards...you have a bank card....only use it. Yes, you had a lot happen in a short period of time, but the good news is it's over and done with now. Move forward and clear the debt....it won't take long with yalls income.

Since I rarely give sincere advice, so here's a curveball...

1. toss your ego out the door. this is the hardest part. most people can't do it. I struggle at times. Focusing on my kids helps me recenter when I get urges to look at new vehicles, custom fishing rods, saltwater fishing reels, event tickets, expensive meals, etc). I always ask myself "is this going to help either of my kids 5 years from now?"

2. with your ego out the door, understand and accept you are not as smart as you think and it's TOTALLY ok to take advice from people who you perceive as not as smart as you. I suffered from this. My ego prevented me from taking good advice from good people because "I was too smart for that".

3. to cap off your loss of ego, take Financial Peace University (yes, I know. Dave Ramsey is a moron and church isn't cool, but whatever. The principles are sound and work for the majority of people.) Don't to the online version. Do the in-person version. I begrudgingly trudged through it because my wife wanted to and I'm glad I did. It was worth it.

For me, it wasn't about a budget. It was about discipline and priorities. If you don't have discipline, you can't stick to a budget. It's impossible.

1. toss your ego out the door. this is the hardest part. most people can't do it. I struggle at times. Focusing on my kids helps me recenter when I get urges to look at new vehicles, custom fishing rods, saltwater fishing reels, event tickets, expensive meals, etc). I always ask myself "is this going to help either of my kids 5 years from now?"

2. with your ego out the door, understand and accept you are not as smart as you think and it's TOTALLY ok to take advice from people who you perceive as not as smart as you. I suffered from this. My ego prevented me from taking good advice from good people because "I was too smart for that".

3. to cap off your loss of ego, take Financial Peace University (yes, I know. Dave Ramsey is a moron and church isn't cool, but whatever. The principles are sound and work for the majority of people.) Don't to the online version. Do the in-person version. I begrudgingly trudged through it because my wife wanted to and I'm glad I did. It was worth it.

For me, it wasn't about a budget. It was about discipline and priorities. If you don't have discipline, you can't stick to a budget. It's impossible.

Just imagine if he had a wife and the girlfriend was two hours away, the time wasted on commute would be astronomical!No wife and girlfriend 2 hours away? Man, you have hit the sweet spot on that. Congratulations.

We were 13 years married before buying a single piece of new furniture. Our house had used appliances….not junk but very reliable brands. Our cars were always used but also reliable brands. Credit card had to be paid in full monthly or did not use it. Fortunately my dad was a Mr. fixit and taught me how to do a lot of stuff on my own which saved quite a few dollars over time. Best advice: do not try to keep up with seemingly rich friends and associates. Most of the time those “rich” folks struggle mightily! Stay in your lane. Then one day you will wake up and realize you have actually achieved financial independence.

If you have the discipline, I also highly recommend using a credit card for every purchase. Then use a budget, account aggregator that you can go look at your finances and cash flow daily. Something like Monarch or Empower. Using a CC allows these services to automatically bucket expenses and help you monitor expenses, cash flow, budgeting in real time.

Put money in the 401k get your self a nice emergency fund and stop worrying..you are probably at your lowest earnings point. Life is hard but worring and hand ringing make it worse. All are correct on no vacations. We never had a vacations. I was 40 when my wife took kids to the beach for the first time. . I’m 57 I can remember the first few years being hard money wise but it gets better. ETA. Paying for private school is a *****.

I agree with using credit card. Just pay it off at least weekly; maybe have a set day of the week you pay it off. It helps you visualize how much you spend each week/month. And you get a little free money with the rewards.

Last edited:

For a great online budget system, checkout you need a budget dot com. Ynab.com

Shameless plug: use my referral code!

https://ynab.com/referral/?ref=u-16g5vkxoj9-tKz

Shameless plug: use my referral code!

https://ynab.com/referral/?ref=u-16g5vkxoj9-tKz

Last edited:

Which you can change....it's up to you if you settle for making less money.Yeah....there's really no argument against it. The drawback is if you don't have good income.

I don't know if the double number is correct, but both spouses working adds stress (getting off for sick childcare, getting off to work/daycare every morning, night time meal time, etc.) and costs like gas, clothes, kids and you being sick from the little petri dishes dragging home every bug from daycare, etc. So, if one or the other's isn't significantly over what childcare costs are, there is an argument that it isn't worth it.Out of curiosity, what's the basis for this line of thinking? Why double? And does your position change if they have 3 kids instead of 1?

I've seen a number of stay home dads. I could not achieve this level of winning, though and consider myself an abject failure for marrying for love and not money.***...or maybe he stays home if she is making more. Wild possibility, I know.

Anyways, I don't know where the cutoff is for making it worthwhile to stay home or work, when it comes to daycare.

At $300 per week for daycare and 60% takehome, you are saying someone should stay home if they earn less than $52,000 annually.

So you save daycare expenses, but you give up $15,000 in additional household income, give up growing 401k thru investment and matching, and you would have food expenses that would be included in the daycare expenses.

Note: you are correct in that a teacher career is barely impacted financially, but if you teach in public schools and do this, your retirement will be pushed by the number of years you are not working. In my case this resulted in my wife's retirement age being *gasp*, 56, if she chooses to stop teaching then...Depends on what she does and if she's ever planning on working again... Not a big deal if she's a school teacher or nurse and can effectively pick it right back up. But stalling your career for 5-10 years is a killer in the corporate world.

My wife was in her late 20's and early 30's making probably less than double our child care expenses when we first had kids. She was also paying her dues and really laying the foundation for her career. She continued working and by 40 she was a senior executive for a multi billion dollar company making 10-20x the cost of daycare. Had she stayed home she would probably be working in a local insurance office as an admin assistant or something.

The single greatest financial decision of our lives was having my wife continue to work and putting our kids in daycare vs having her stay at home and freelance.

I just completely made up the "double" figure. My best advice is to do the opposite of my advice.I don't know if the double number is correct, but both spouses working adds stress (getting off for sick childcare, getting off to work/daycare every morning, night time meal time, etc.) and costs like gas, clothes, kids and you being sick from the little petri dishes dragging home every bug from daycare, etc. So, if one or the other's isn't significantly over what childcare costs are, there is an argument that it isn't worth it.

Unsolicited advice: I believe that the idea that we are responsible for our children's college costs is a lie that adds undue stress to us.We have a 529 plan for my daughter that I wish had more in it but I’ve got time to catch up, as she’s 16 years away from college. But yeah student debt sucks. I was fortunate to not have any but I married into a good bit of it. That said I take responsibility for dealing with it too and I definitely want my daughter to have school paid for as much as possible.

Did I do everything I could to help my kids in college and getting started in life? Yes.

Did I consider myself a failure because I could not amass six figures of college funds for each one of my kids? No, and I don't believe that anyone should.

If people want an education, they can get one. You could even offer to pay back their student debt, as I have done, for good grades. It is much easier for me to help them on student loans now that they are off my payroll and I'm at peak earning potential, than it was for me to save enough to fully fund their college.

This may not be directed at you, even, but I've seen many friends completely stressed and think they were failing because they could not fully fund college for their kids.

Times have changed. My FIL hitchhiked to MSU with a bag of clothes to start school. I drove myself and my belongings and moved myself in. My generation has somehow gotten caught up in dorm room decorating competitions between competing moms...

I disagree. I get 4% back on my CC on food and pay it off every month. No way I'd be better off using my bank card. Of course, my general opinion of Dave Ramsey is that he is great for someone who has little budgeting knowledge or just needs a plan to add discipline that they can't do on their own.The Ramsey plan works every time if you stick to it & follow it...first thing is to do a line item budget, and both of you stick to it. You'd be amazed how much trickles away. It won't work if you don't follow the rules or half-*** it. Get a small emergency fund(which you already have), and stop investing long enough to get that student loan paid off. Throw ALL extra money at your only debt, then you can start back....it won't take that long when throw big chunks at it.

Cut up all the credit cards...you have a bank card....only use it. Yes, you had a lot happen in a short period of time, but the good news is it's over and done with now. Move forward and clear the debt....it won't take long with yalls income.

Anectdote: I very recently helped a friend who was in struggling with rent/ins/auto payment after losing a job and stepping down to a lower paying one. When I started questioning him to see how to best guide him, I found out that he wasn't making much less than before, but he had gone from weekly pay to bi-weekly pay and he couldn't figure out how to budget...

Lots of people will tell you (see this thread), you have to live like a hermit and not enjoy life if you want to have money. They aren't wrong but working to live a ****** life of no fun aint it. Bottom line, unless you make bank, win bank, or inherit bank, chances are, you won't ever meet all the goals you'd like and that's damn life. Having a family is the single greatest expense too. Live an enjoyable life and don't stress the money. Avoid debt as much as possible. Track your income/expenses. I had to learn that myself. I was a much more miserable asshat to my family when I stayed worked up about money. Oh, and divorce will rape your finances by the way.

A vast chunk of money managing is simply common sense and dissipating emotional decisions.

A vast chunk of money managing is simply common sense and dissipating emotional decisions.

Several years ago, I was approached to see if I was interested in applying for a position outside PERS. I listened because I was feeling stagnant at my previous post.Note: you are correct in that a teacher career is barely impacted financially, but if you teach in public schools and do this, your retirement will be pushed by the number of years you are not working. In my case this resulted in my wife's retirement age being *gasp*, 56, if she chooses to stop teaching then...

I wasn’t yet service retirement eligible, the salary range was lower than I would have liked, and I didn’t want to make significantly less money for a few years so I passed on applying.

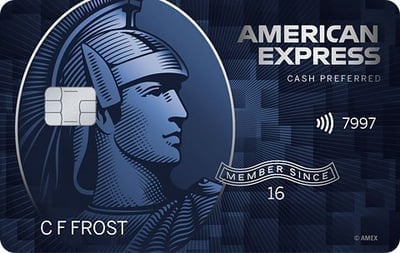

The American Express Blue card is fantastic for groceries (6%) and several other categories, highly recommend.I disagree. I get 4% back on my CC on food and pay it off every month. No way I'd be better off using my bank card.

Rewards:

- 6% cash back at U.S. supermarkets, on up to $6,000 in spending per year.

- 6% cash back on select U.S. streaming subscriptions.

- 3% cash back at U.S. gas stations.

- 3% cash back on transit.

- 1% cash back on other purchases.

American Express Blue Cash Preferred Review - NerdWallet

American Express Blue Cash Preferred earns high rewards at U.S. supermarkets and gas stations, on streaming and on transit. There's an annual fee, but families can earn that money back many times over.www.nerdwallet.com

As the late, great, Lewis Grizzard once said: "I'm not getting married again. The next time, I'm just going to find a woman I hate and give her half my stuff."Lots of people will tell you (see this thread), you have to live like a hermit and not enjoy life if you want to have money. They aren't wrong but working to live a ****** life of no fun aint it. Bottom line, unless you make bank, win bank, or inherit bank, chances are, you won't ever meet all the goals you'd like and that's damn life. Having a family is the single greatest expense too. Live an enjoyable life and don't stress the money. Avoid debt as much as possible. Track your income/expenses. I had to learn that myself. I was a much more miserable asshat to my family when I stayed worked up about money. Oh, and divorce will rape your finances by the way.

A vast chunk of money managing is simply common sense and dissipating emotional decisions.

Definitely understand that school of thought. My wife and I had two very different experiences with this when we were both students and where we ultimately landed was we are going to put money into a 529 (currently like $1,000 per year) and just let it grow in the market over time. Not committing to pay for the whole thing and hopefully my daughter ends up being a very good student with lots of scholarship money. But there’s going to be some money available to assist or hopefully cover a nice chunk of it. There is a good chance she’s the only kid I ever have and I would like to limit how much debt she starts her career with as much as possible.Unsolicited advice: I believe that the idea that we are responsible for our children's college costs is a lie that adds undue stress to us.

Did I do everything I could to help my kids in college and getting started in life? Yes.

Did I consider myself a failure because I could not amass six figures of college funds for each one of my kids? No, and I don't believe that anyone should.

If people want an education, they can get one. You could even offer to pay back their student debt, as I have done, for good grades. It is much easier for me to help them on student loans now that they are off my payroll and I'm at peak earning potential, than it was for me to save enough to fully fund their college.

This may not be directed at you, even, but I've seen many friends completely stressed and think they were failing because they could not fully fund college for their kids.

Times have changed. My FIL hitchhiked to MSU with a bag of clothes to start school. I drove myself and my belongings and moved myself in. My generation has somehow gotten caught up in dorm room decorating competitions between competing moms...

Or if she decides she doesn’t need college for whatever reason or gets a full ride, ok cool, I’ll transfer the 529 to another family member. I think my wife would love to get her specialist’s or doctorate degree but it’s not totally essential in her career field and we’ve decided to prioritize other things first.

My budgeting tips:

-Don’t get married

-Don’t have kids

-Don’t be an alcoholic

-Don’t be a nicotine addict

-Don’t be a caffeine addict

-Don’t hunt or fish (especially offshore)

I’d be rich had I not failed (and continue to fail) at each of these.

-Don’t get married

-Don’t have kids

-Don’t be an alcoholic

-Don’t be a nicotine addict

-Don’t be a caffeine addict

-Don’t hunt or fish (especially offshore)

I’d be rich had I not failed (and continue to fail) at each of these.

Smart. Funny enough, I have more money in 529s for my grandkids than I ever was able to save for my own kids.Definitely understand that school of thought. My wife and I had two very different experiences with this when we were both students and where we ultimately landed was we are going to put money into a 529 (currently like $1,000 per year) and just let it grow in the market over time. Not committing to pay for the whole thing and hopefully my daughter ends up being a very good student with lots of scholarship money. But there’s going to be some money available to assist or hopefully cover a nice chunk of it. There is a good chance she’s the only kid I ever have and I would like to limit how much debt she starts her career with as much as possible.

Or if she decides she doesn’t need college for whatever reason or gets a full ride, ok cool, I’ll transfer the 529 to another family member. I think my wife would love to get her specialist’s or doctorate degree but it’s not totally essential in her career field and we’ve decided to prioritize other things first.

It's really not an odd assumption. Aside from the fact that a husband in the US is more than 2 times as likely to make more than his wife than vice versa, it's not relevant for most people how much more a man makes than daycare. While there are tons of benefits to having a stay at home parent, for most couples, those benefits would be more than offset by the strain on the marriage, if not divorce. Women who outearn their husband tend to report being dissatisfied at a much higher rate than women who don't (something like 75% to 50%). That's just the numbers for women who outearn there husbands period, so it would include couples where the difference is minimal. If you make the woman the sole breadwinner, what do you think that percentage is going to be? That's too big of a risk for most couples. And I doubt it helps much if the woman thinks it won't be a problem. People in general are pretty bad about predicting what will make them happy and I suspect women on average might be worse at it than men going by the happiness trends of women over the last 60 years.17 off. I wasn't argumentative- I was pointing out that assuming the wife makes less is an odd assumption- and then I quickly moved on to discuss the idea that 2x the cost of day are is what's needed for takehome pay for daycare to be the correct choice.

If someone wants to argue against my first point, then they are the one arguing.

Last edited:

This was basically the same choice we had. It wouldn't have been a sacrifice at all for her to stay at home when the kids were in daycare compared to the amount she was making when daycare started. But even before we had them all out of daycare, her income had grown to the point that it would have been a huge sacrifice to give it up.Depends on what she does and if she's ever planning on working again... Not a big deal if she's a school teacher or nurse and can effectively pick it right back up. But stalling your career for 5-10 years is a killer in the corporate world.

My wife was in her late 20's and early 30's making probably less than double our child care expenses when we first had kids. She was also paying her dues and really laying the foundation for her career. She continued working and by 40 she was a senior executive for a multi billion dollar company making 10-20x the cost of daycare. Had she stayed home she would probably be working in a local insurance office as an admin assistant or something.

The single greatest financial decision of our lives was having my wife continue to work and putting our kids in daycare vs having her stay at home and freelance.