View attachment 302197

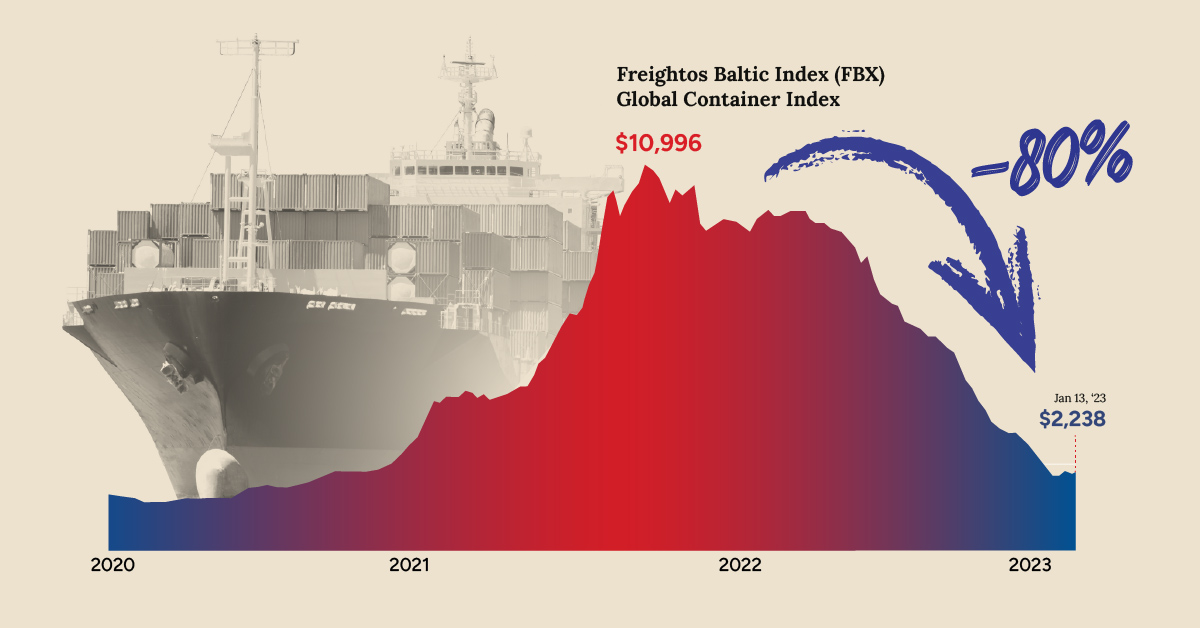

After a dramatic spike during the pandemic, shipping costs have now fallen back to Earth. What does that mean for shippers and the economy?

www.visualcapitalist.com

Now we need a lumber update from

@PooPopsBaldHead

It would appear the lumber futures market has at least put in a tactical bottom, if not a permanent one back in December. Its up 27% since then.

Much like other commodities (oil, gas) at certain prices it becomes cost prohibitive to continue to produce more product. Mills have started production curtailments to keep from losing more money. So even with considerably weaker demand, it appears some balance has been found.

The way it has worked with lumber historically is it trades in a range for 20 -30 years (which it did from 1992-2020) and once some catalyst breaks it out of the old range, the old ceiling becomes the new floor.

I guess theoretically, we could go back to the old range and stay, but that would require mill workers to give back all the pay raises, loggers that retired to get back in business, and oil to go back to $40 a barrel. Other factors such as Canadian lumber tariffs and the exhaustion of beetle kill spruce in BC make it unlikely to see that happen though.

Here's a monthly price chart of lumber futures going back nearly 40 years. In full disclosure, I dropped in that yellow dashed line back in August of 2021 as my guess on what lumber prices would do moving forward. It really just mimics the prices of previous cycles. On the whole, it's not to far off, but the recent bottom was lower than I expected as interest rates have gone way higher than I would have thought 18 months ago.

Net net... If you are building a shed, deck, or paying cash for some other project, you can effectively buy lumber today at the same price you could 30 years ago. Not much downside risk from here so get after it. If you are building a house or big addition that requires a mortgage, that stinks because high interest rates more than outweigh cheap lumber. Hopefully in another 12-18 months we achieve better balance of interest rates, labor, and materials... But that is up to the Federal Reserve.

www.visualcapitalist.com

www.visualcapitalist.com